05Jun

Can I Refinance my Fixed ARM Loan?

Refinancing now is hedging your bets against higher later this year!

Rates are on the rise. Refinancing from a Fixed ARM to a Fixed ARM can be a successfully strategy in reducing your lifetime interest expenses.

Rates move in cycles that can span months or years. However, there are always dips! I generally recommend that within 2 years of a Fixed ARM term ending, that you start aggressively looking for a dip in the market to refinance. If you are not watching the market daily, then having a partner (loan officer) watching for you is important.

The risk of ARM loans is that they "roll-off" into an adjustable at the end of your fixed term and then adjust annually. Taking a similar or lower rate TODAY vs waiting a couple years is a sound strategy!

There are 2 keys to a successful ARM Refinance strategy:

-

- 1) Take advantage of interest rate dips when they occur - Act Quickly!

-

- 2) Paying no transaction costs with a COST FREE loan. This removes the costs barrier to frequent transactions.

The ARM strategy is even more important when we are in a Federal Reserve rate hike cycle.

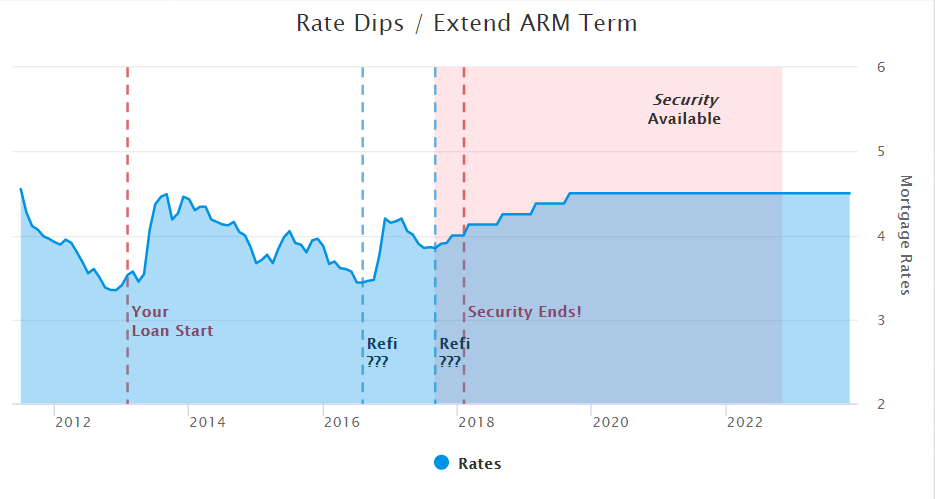

The chart below illustrates the strategy. In the summer of 2016 and Aug 2018, rates were well below the preceding 6 month high and presented a perfect time to jump into another Fixed ARM loan. The result, Fixed Term extended!

If the Fixed ARM loan you have now will start adjusting within the next 24 months, then give me a call!

By implementing these strategies, you can benefit with the lower ARM rates while maintaining the security of a fixed rate for decades!

Related

The most common conversation that I have with clients involves - what does it take to be qualified f...

Read More >

Cash-Out loans can help you improve your overall cash flow and help improve credit score all at the ...

Read More >

You have to out-bid or out smart cash buyers! Having a strategy early in the process is critical to...

Read More >

The Cost of Waiting is sometimes more expensive than the refinance transaction itself!

Read More >

Investment properties can be very lucrative if you have sufficient capital, credit score, and time m...

Read More >

Given a choice between Mortgage Brokers or Mortgage Lenders - choose the Broker!Why? It boils down t...

Read More >